by Venturans for Responsible & Efficient Gov’t

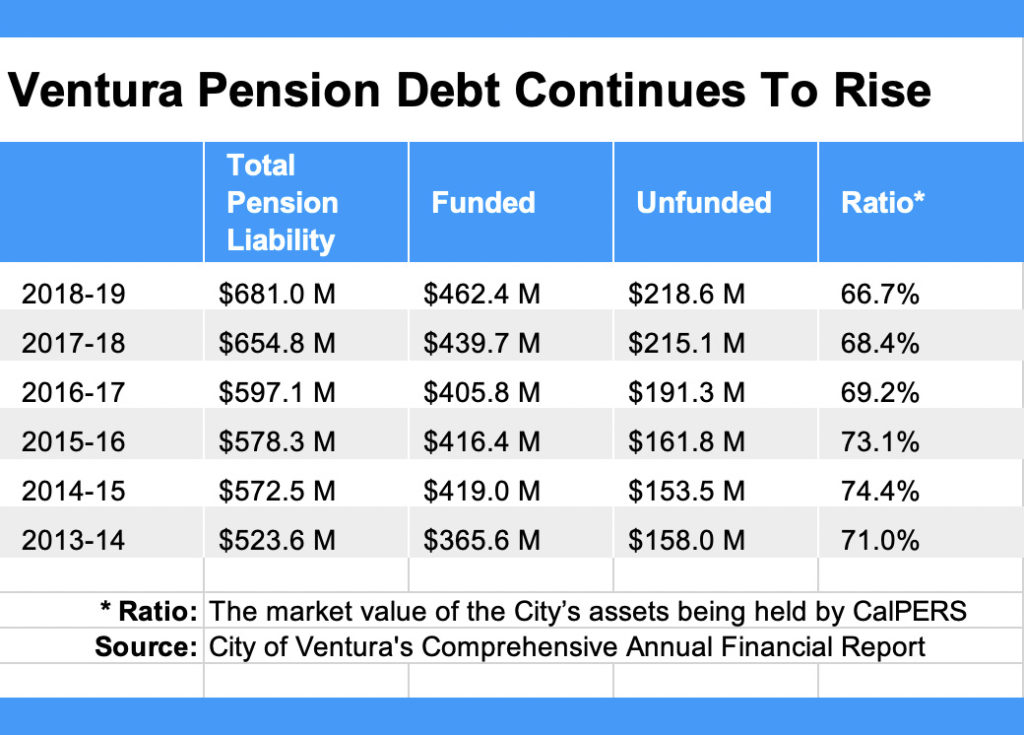

Ventura’s unfunded pension liabilities continued to grow in 2019 to $218.6 million. The City of Ventura continues to sink deeper into debt to pay for city employees’ present and future retirement benefits. Unfortunately, the economic reality of the city’s current public pension liabilities is not receiving the attention it demands.

Revised Unfunded Liability Figures

The new unfunded pension liabilities figures come from the 2018-2019 Comprehensive Annual Financial Report (CAFR). Ventura added $3.5 million to its unfunded liabilities. Simultaneously, the market value of Ventura’s assets held by CalPERS dropped to 66.7%, a multi-year low.

A Political Hot Topic

Discussions about pensions get emotional because we’re talking about people’s future and security. Let’s be clear. We respect the work city employees do. There is no denying that fire and police perform a vital job that is both dangerous and requires a high level of training and responsibility.

Our concern is not about their work. We’re uneasy about how the city structures, accumulates and pays retirement benefits.

Neglecting The Unfunded Pension Liabilities Doesn’t Make Them Disappear

For ten years, Ventura has done little to remedy the unfunded pension liability. During that time, there have been four different City Councils. Yet, they made only a modest effort to solve the problem. Then-Mayor Bill Fulton and City Manager Rick Cole claimed in 2011 that the City of Ventura had tilled new ground by requiring the city employees to pay something toward their retirement – 4 ½%.

Yet, closer scrutiny showed employees pay their 4 ½% retirement contribution toward the employers’ portion (i.e., The taxpayers’ portion) of what Ventura sends to the CALPERS retirement plan. This accounting maneuver explicitly increases the employee’s total compensation, meaning the “contribution” counts as the employee’s income to calculate the employee’s retirement benefit when they retire.

Suggestions For Addressing Unfunded Liabilities

There are two other choices for our City Council to consider if they have the political will.

1. Make beneficiaries pay more. Capping the employer contribution at a fixed percentage of salary would cut pension costs for the city. As pension costs increase over the years, the employees will pay all the growing costs.

2. Change when retired city employees may begin collecting pensions. This alternative solution applies to new employees only. What if police and fire could vest their generous pensions in full by age 50 or 55, as they do now, but the payments did not start until age 65? At current official pension growth rates, that would more than double the fund’s value over those ten years. Also, the retirement payment period would be ten years shorter, given the same life expectancy.

Public sector employees may resist the changes but this solution makes sense. Private sector employees don’t get their full social security until 65 or even 67, depending their birth year.

Raw Political Power Behind Unfunded Pension Liabilities

Ventura’s city employee unions negotiate higher and higher salary increases disregarding any concern that the money may not be available to pay their pensions once they retire. Union negotiators believe a virtually ironclad guarantee exists for the workers to whom the city promised the pension benefits. Many Councilmembers accepted the same thing, although it’s no longer valid. A Federal Bankruptcy Court ruled otherwise in January 2015.

The impact of this decision is that CALPERS cannot stop cities from modifying pensions. Yet, the Ventura City Council appears unaware of the findings.

Editors Comments

Past retirement pension negotiations were based on union bargaining and raw political power, creating a gap between what politicians promised and what cities can really pay. It will take political will to bring the retirement benefits back to reality. Changing the system is the only way these promised benefits can be sustainable and dependable for retirees. It’s also the only way that taxpayers can afford to pay for them.